Dubai Real Estate Snapshot: August 2024

Dubai’s residential real estate market continues to show remarkable growth and resilience in August 2024, with significant gains across both villa and apartment sectors. This analysis provides insights into the current state of the market, highlighting key trends and performance indicators.

Overall Market Performance

The Dubai residential market experienced a 2.2% month-on-month growth in August 2024, representing a substantial 28.8% increase compared to the same period last year. This strong performance underscores Dubai’s position as a leading global real estate market, outpacing growth rates in the US where real estate sales volumes declined month on month by 2.5% according to the National Association of Realtors 1.

Segment Analysis

Villa Segment

The villa segment continues to lead the market with a monthly increase of 2.4% and an impressive year on year growth of 33.5%. The average capital value for villas now stands at AED 10,555,482, with an impressive price per square foot of AED 2,244.

Top Performing Villa Areas:

- Palm Jumeirah: 42.9% annual increase

- Jumeirah Islands: 42.4% annual increase

- Dubai Hills Estate: 36.9% annual increase

- Emirates Hills: 34.3% annual increase

Jumeirah Islands has been the turnaround location for many property owners in recent years. For the most part, it has been a quite neighborhood in Dubai, parallel to Emirates Living and Jumeirah Park which have seen consistent appreciation over the years. With only 800 villas in 50 clusters of 16 villas each, it is a relatively small community of 3 types of properties, Entertainment Foyer, Garden Hall and Master Views.

However, in recent years, people realized this area has tremendous value as 60% of the villas have direct water views and it is somewhat insulated from the hustle and bustle of other neighbourhoods such as Emirates Living and Jumeirah which have schools, hospitals, cafes and restaurants.

As a result, villas in this small area have more than doubled in value over the past 2-3 years due to it’s amazing views of the waterways that intersect the community, their large plot and built-up areas and their excellent location. A lot of new buyers have decided to buy, gut and renovate these villas which were handed over in 2006 (over 18 years ago as of 2024). A villa in cluster 39 for example was sold in 2022 for AED 9.1m. The same villa today without upgrades would be for AED 16m and with upgrades would be around AED 22m.

Apartment Segment

The apartment sector also showed strong growth, with a 2% monthly increase and a 24.4% annual growth. The average capital value for apartments is now AED 1,615,827, with a price per square foot of AED 1,214.

Top Performing Apartment Areas:

- Discovery Gardens: 34.2% annual increase

- The Greens: 33.6% annual increase

- Palm Jumeirah: 30.3% annual increase

- The Views: 30% annual increase

Discovery Gardens has seen some positive activity recently. With Nakheel PJSC cleaning up the area and ensuring it is a family friendly environment, they have encouraged bachelors to vacate sharing rooms and made way for families to occupy these homes. Furthermore, the launch of the red line of Dubai Metro, the whole is area is not easily connected to the rest of Dubai. With a lot of working families residing in this area, this public transport has made it easy for them to commute to and from work and avoid traffic, salik and parking hassles to get to their offices.

Transaction Volume and Market Trends

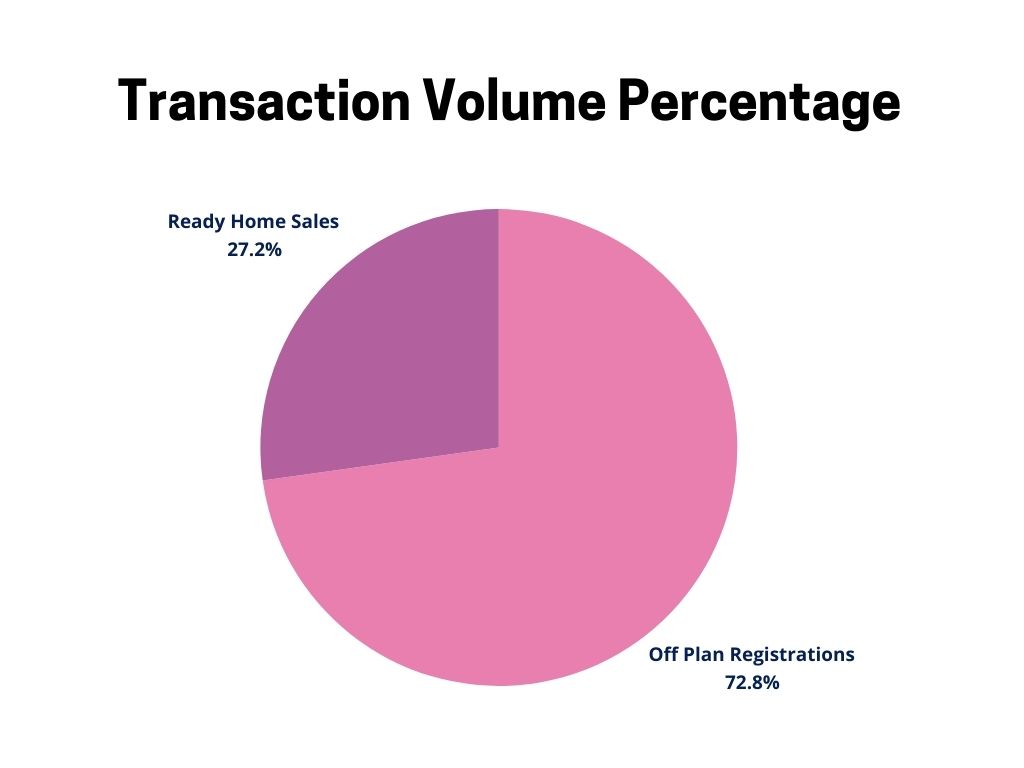

August 2024 saw a continued shift towards off-plan properties:

- Off-plan registrations: 10,364 transactions, up 46.4% year-over-year

- Ready home sales: 3,876 transactions, up 10.2% year-over-year

The off-plan market now represents almost three-quarters of all home sales, indicating strong investor confidence in future developments. This signifies that there are a lot of people that prefer to buy something and wait to take possession rather than buy now and pay heavy mortgage fees.

Developer Performance

The top developers by sales volume in August 2024 were:

- Emaar Properties PJSC: 22.5%

- Sobha Real Estate L.L.C: 8.7%

- Azizi Developments: 5.8%

- Damac Properties: 5.5%

- Danube Properties: 5.2%

Sobha is gaining momentum and quickly becoming a household name in Dubai. With Sobha Hartland having established itself as a prominent community right at the centre of the city and Sobha Hartland 2 underway, they have a lot to offer current residents and new buyers. You can learn more about Sobha in our blog post here.

Luxury Market

The prime property segment remained active, with 13 transactions for ready properties priced over AED 30 million. These high-value sales were concentrated in prestigious areas such as Palm Jumeirah, Emirates Hills, and Dubai Hills Estate. You can see an example of a luxury property in Damac Hills listed on Viewit here.

Market Outlook

The consistent and robust growth across all segments of Dubai’s real estate market indicates a positive outlook for the coming months. The continued preference for off-plan properties suggests strong investor confidence in the city’s future developments.

As global economic uncertainties persist, Dubai’s real estate market stands out as a beacon of growth and innovation, attracting all the skittish investors to a secure, safe and stable market. The city’s strategic initiatives, favorable tax policies, and ongoing infrastructure developments continue to attract both local and international investors.

While the rate of price appreciation remains high, it’s important for stakeholders to monitor the market closely for any signs of overheating. However, given the Dubai Land Departments tight regulations on the market and price controls with respect to resale and rentals, the current data suggests that Dubai’s real estate sector is poised for continued growth in the near term, outperforming many other global real estate markets.

Citations:

[1] https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/23087013/bb17d7eb-a591-4c4c-9251-04759c0433cb/VPI_Dubai_Residential_Values_-_August_2024.pdf

Share this article on: